Managing a rental can be straightforward — or it can eat your evenings and weekends. Fortunately, property management companies exist to take the admin, compliance and tenant headaches off your plate. This guide explains what they do, how much they charge, the legal must-dos for landlords in 2025, and how to choose the right provider for your needs.

Instant Rental Price Estimator

Discover your property’s true rental value in seconds with our free, UK-wide price comparison tool.

- What do property management companies do?

- Legal essentials every landlord must know

- Typical fees and how to compare them

- How to choose a property management company

- Compare property management companies and fees

Quick summary

-

Outsource time-consuming tasks to property management companies, such as tenant sourcing, rent collection and compliance.

-

Typical clients: busy landlords, overseas owners and multi-property portfolios.

-

Read on for fees, legal must-dos and a checklist to compare managers.

What do property management companies do?

Most property management companies offer a menu of services you can mix and match:

-

Let-only / tenant-find — advertise, conduct viewings and place tenants.

-

Tenancy setup — draughting/issuing tenancy agreements, deposit registration, check-in inventories.

-

Rent collection & accounting — monthly rent collection, chasing arrears, financial reporting.

-

Full management — day-to-day repairs, emergency callouts, contractor management and periodic inspections.

-

Legal & compliance support — safety certificates, eviction support, deposit disputes.

-

Value-added services — online landlord portals, rent protection insurance, HMO management, and tax/accounting help.

Additionally, the trend in 2025 is flexible, hybrid packages — you can often combine let-only with ad-hoc management services to suit your budget. Landlord Services

Legal essentials every landlord must know

Landlord compliance changes frequently; therefore, these points are the basics you must keep in order (and property managers usually handle them for you):

-

Gas safety — landlords must have gas appliances checked annually by a Gas Safe engineer and keep the record. Gas Safety

-

Electrical safety (EICR) — properties require an electrical installation inspection and report at least every five years (or sooner if the inspector advises). Electrical safety

-

Deposit protection — deposits for most assured shorthold tenancies must be placed in a government-approved deposit scheme within 30 days of receipt. Deposit protection

-

Tenant Fees Act (England) — many tenant charges are banned; check which fees are lawful to avoid hefty penalties. Tenant Fees Act

-

Licensing & local rules — many councils run selective or additional licensing in certain areas (and more schemes have been introduced recently). Check if your property’s council requires a licence. GOV.UK

If you’re unsure about any requirement, a professional manager will advise and help you evidence compliance.

Ask questions, get advice, and get started today.

Typical fees and how to compare them

Fees vary by service level, location and company size. Typical current ranges (illustrative):

-

Let-only / tenant-find: Often a one-off fee equal to 8%–12% of one year’s rent or a single month’s rent.

-

Rent collection: ~3%–12% of monthly rent (added to a base or bundled).

-

Full management: Generally 8%–20% of monthly rent — urban areas and specialist HMO management can be higher.

Importantly, always check what’s included (renewal fees, inventories, check-outs, eviction admin, emergency callouts) and whether fees are subject to VAT. Some providers now offer fixed-fee management for higher-rent properties where percentage fees are costly. Compare Agent Fees

Pros and cons — the practical picture

On the plus side — Pros

-

Saves time and stress — contractors, emergencies, and tenant queries handled for you.

-

Better compliance risk management — managers usually keep certificates, test dates and documentation up to date.

-

Faster lets and professional marketing — may reduce voids.

On the downside — Cons

-

Fees reduce net yield — the key question is whether the time saved and risk reduced are worth the cost.

-

Less direct control — you’ll rely on the manager for tenant selection and day-to-day decisions.

-

Service quality varies — always check customer reviews and references.

How to choose a property management company (step-by-step)

-

Firstly, define what you need — tenant-find only, rent collection, or full management? Be explicit.

-

Secondly, compare apples-to-apples — get written fee breakdowns and a sample contract. Look for hidden extras (renewal, inventory, contractor margins).

-

Check compliance support — will they manage gas, EICR, deposit protection, safety certificates and licensing?

-

Local market knowledge — do they know your neighbourhood’s rent levels and tenant demand?

-

Reputation & reviews — Google, Trustpilot, local landlord networks. Ask for landlord references.

-

Communication & reporting — online landlord portal? Frequency of updates? Access to statements?

-

Exit terms — what happens if you want to switch? How long is the notice period and what are the handover obligations?

Practical checklist before signing

-

For example, do they register deposits in a government-approved scheme? (Confirm which scheme.)

-

Will they arrange annual gas checks and EICR inspections? (Ask for the certificates.)

-

Are renewals, inventories and check-outs included or extra?

-

What marketing channels do they use to find tenants?

-

Do they perform Right to Rent checks and keep records? (Processes have moved towards digital checks — follow the latest Home Office guidance.) GOV.UK

-

Are there any local licences or selective licensing that apply to your property? (Council rules differ — check your local authority.) GOV.UK

Examples of flexible service levels (real-world scenarios)

-

Overseas landlord — For instance, an overseas landlord may prefer full management plus an online portal and local compliance checks (ideal for landlords who can’t be on-site).

-

High-rent city flat — fixed-fee management may be better than percent fees (the math often favours fixed pricing at higher rents).

-

Portfolio landlord — a bespoke account manager, bulk pricing and consolidated reporting across properties.

FAQs (short answers for busy landlords)

Q: Are property management companies worth it?

A: In many cases, if you own multiple properties, live far away, or want to reduce legal risk and time spent, they usually pay for themselves in saved time and fewer compliance problems.

Q: Can I keep control of tenant decisions?

A: Yes — many companies operate under agreed authorisation levels so you can approve certain decisions.

Q: What happens if a tenant damages the property?

A: Managers normally organise repairs and handle insurance claims or deposit deductions, but check the contract to see how costs are recovered.

Q: Are management fees tax-deductible?

A: Letting-related fees are typically allowable expenses — check with an accountant for your situation.

Want a fast way to compare property management companies and fees?

If you’d like a quick comparison of property management fees and services, try a trusted comparison tool — it can reveal potential savings and show what’s typical in your area. For an option tailored to landlords, see LettingaProperty’s comparison page.

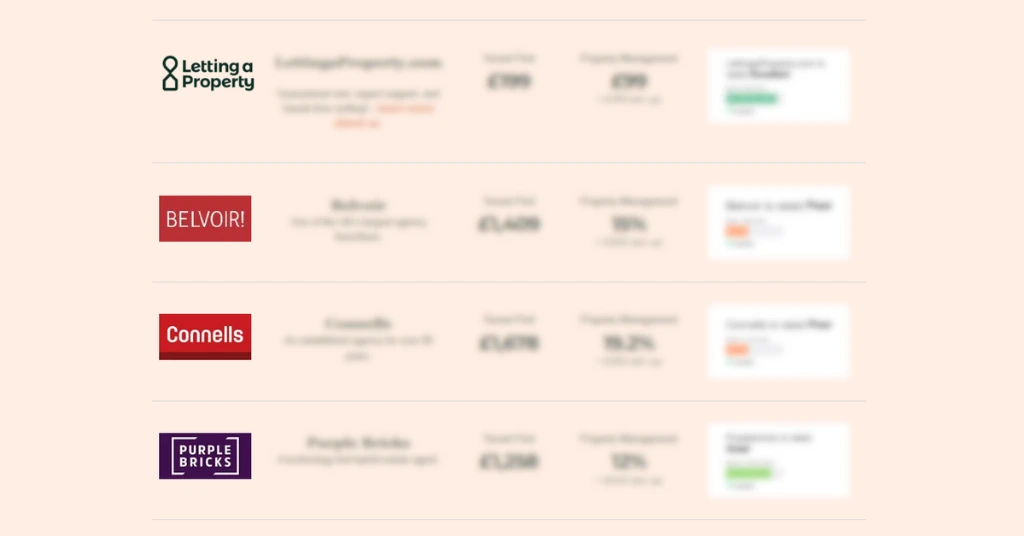

We’ve compiled a list of the most popular letting agents and their fees, updated quarterly. The last update was in August 2025.

You can save up to £1,966 every year by comparing property management fees. Start your free comparison and see how much more you could earn from your rental.

- Enter your postcode

- Compare fees & ratings

- Maximise your returns

Whether you’re considering let-only, rent collection, or full management, we’ll help you make an informed decision—and save money along the way!

Here’s a sneak preview…

Why choose LettingaProperty.com to reduce your property management fees?

If you want to cut costs without cutting corners, LettingaProperty.com is designed for landlords who care about returns and certainty. We combine a simple online dashboard with hands-on support so you get lower fees, professional management, and fewer surprises.

What we offer

-

Simple by Design: A clean, intuitive interface makes managing your property straightforward from day one.

-

Real-Time Insights: Track viewings, applications, payments and more — all live in your dashboard.

-

Support When You Need It: Access help from our property team whenever you hit a snag — we’re here to back you up.

- Income Protection: With Vivo (Our property management platform), rent guarantee comes built in — so you don’t lose out when tenants fall behind.

How it helps

In practice, switching to a smarter service can reduce your overall costs (many landlords save substantially versus high-street fees) while keeping a hands-off, professional service. If guaranteed income and predictable costs matter to you, LettingaProperty is built around those priorities.

Want to value your property?

Get an instant valuation — Free

Ask questions, get advice, and get started today.

Final verdict — should you use a property management company?

Reputable property management companies are a smart choice if you value time, predictability and professional handling of compliance. Alternatively, if you enjoy hands-on landlord work and have a single nearby property, self-management could save you money — but only when you keep up with rules and maintenance.

When comparing providers on fees and services, use a (fees, inclusions, reviews) — this approach will save you money and stress.

For a quick comparison of letting and management fees, see our letting agent fees guide — it’s a good place to start when benchmarking costs against current market rates.