As of 14 May 2025, AML checks for landlords and tenants have become a legal requirement for all UK letting agents. This update brings new responsibilities to the industry—and we’ve already taken action to meet them.

What’s Changed to AML Checks?

The UK government has updated its financial sanctions guidance to include letting agents as “relevant firms.” This means agents must screen every landlord and tenant against the UK Consolidated List of Financial Sanctions Targets. These rules apply to all rental properties, regardless of monthly rent.

📄 Official guidance:

Who Must Be Checked?

Letting agents must now check:

-

Landlords – at the point of instruction

-

Tenants – after the offer is accepted but before signing

-

Guarantors – if they will pay rent or be party to the agreement

If a match is found, the agent must report it to the Office of Financial Sanctions Implementation (OFSI). In such cases, the tenancy cannot proceed until the government gives permission.

What We’re Doing about AML Checks at LettingaProperty.com

To stay compliant and reduce admin for our clients, we’ve added AML screening directly into our referencing process.

We’ve partnered with RentProfile to deliver automated AML checks using trusted global data sources:

-

Dow Jones Watchlist

-

BAE Systems intelligence

-

UK and international databases for:

-

Sanctions

-

Politically Exposed Persons (PEPs)

-

Relatives and Close Associates (RCAs)

-

Special Interest Persons (SIPs)

-

Other Official Lists (OOLs)

-

Importantly, we only report confirmed UK Sanctions matches to OFSI. However, all flagged results are reviewed with a mix of automation and human oversight. This reduces false positives—currently about 90% of hits—so tenancies aren’t delayed unnecessarily.

Platform Update: AML Status Built In

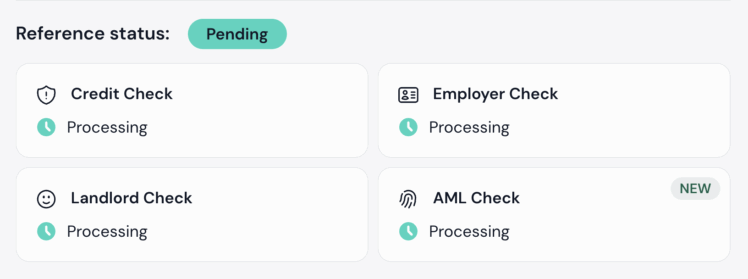

To make this visible and easy to use, we’ve also updated the landlord dashboard.

You’ll now see an AML Check status alongside credit, employment, and landlord checks in the referencing section.

As a result, landlords and agents can stay compliant without changing how they use the platform.

FAQs: AML Checks for Landlords and Tenants

1. Do I need to do anything as a landlord?

No—LettingaProperty.com handles all AML checks as part of our standard referencing. You’ll be alerted only if further action is required.

2. Will this slow down the move-in process?

In most cases, no. The majority of flags are false positives. Our referencing partner reviews them efficiently so tenancies can continue without delay.

3. What happens if someone fails an AML check?

If a person is matched on the UK Sanctions list, we must report it to OFSI and pause the tenancy process until we receive further instructions.

4. Are guarantors included in these checks?

Yes—if the guarantor is financially involved or named on the tenancy, they are included in the AML screening.

5. Is this a permanent legal change?

Yes. These changes apply from 14 May 2025 and remain in effect. All UK letting agents must now comply with financial sanctions obligations.

Photo by Yaopey Yong on Unsplash